UK inflation rate: How quickly are prices rising?

Prices in the UK rose by 3.5% in the 12 months to April, with the inflation rate fuelled by higher household energy and water bills.

Inflation remains above the Bank of England’s target which is 2%. It moves interest rates up and down to try to keep inflation at that level.

The Bank expects inflation to rise again this year after several months of gradual falls. It has cut interest rates four times since last August to the current 4.25%.

What is inflation?

Inflation is the increase in the price of something over time.

For example, if a bottle of milk costs £1 but is £1.05 a year later, then annual milk inflation is 5%.

How is the UK’s inflation rate measured?

The prices of hundreds of everyday items, including food and fuel, are tracked by the Office for National Statistics (ONS).

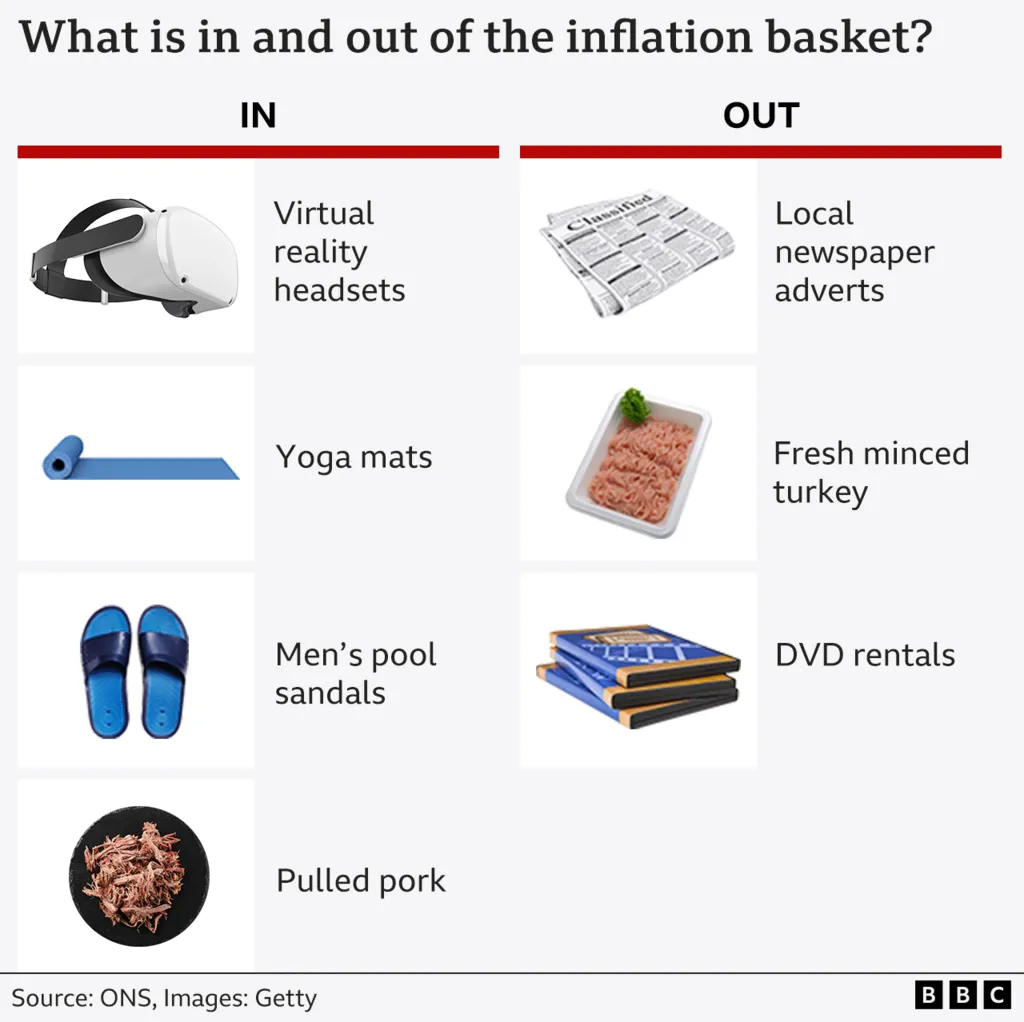

This virtual “basket of goods” is regularly updated to reflect shopping trends, with virtual reality headsets and yoga mats added in 2025, and local newspaper adverts removed.

The ONS monitors price changes over the previous 12 months to calculate inflation.

The main inflation measure is called the Consumer Prices Index (CPI), and the latest figure is published every month.

CPI was 3.5% in the year to April 2025, up from 2.6% in the 12 months to March.