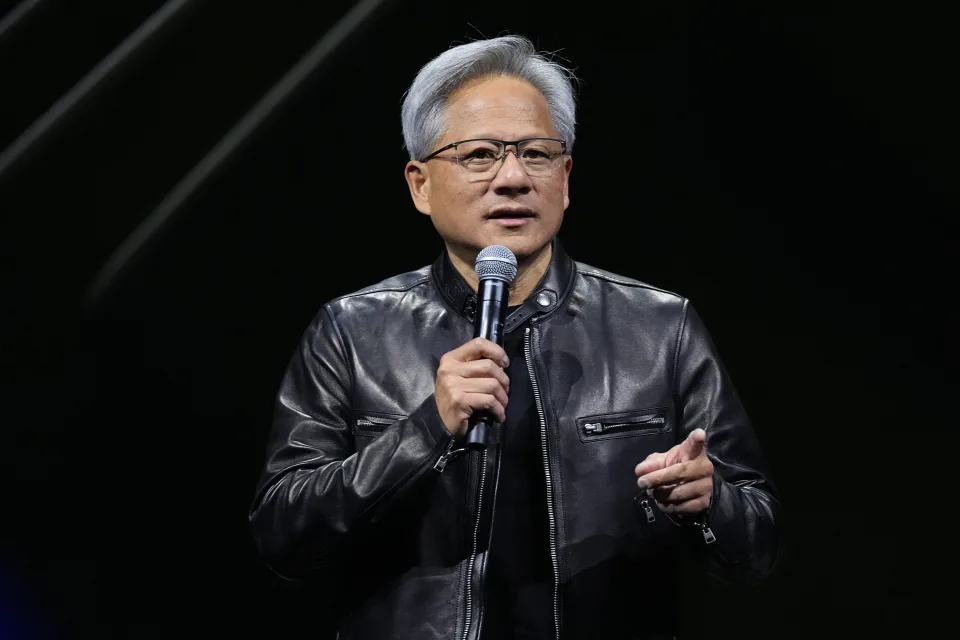

Nvidia to report Q2 earnings Wednesday in major test for AI trade

AI juggernaut Nvidia (NVDA) will report its second quarter earnings after the bell on Wednesday. Nvidia’s announcement — the most anticipated results of the quarter — will send ripple effects throughout the tech sector as investors look for signs that the AI trade will continue to dominate market conversations into the second half of the year.

Nvidia stock is up more than 163% year to date and 60% in the last six months. Rival AMD’s (AMD) stock price is up 9% year to date and down some 14% over the last six months.

Intel (INTC) shares have collapsed 57% since the start of the year and are down 53% over the last six months as the company continues to struggle amid its massive turnaround effort.

For the quarter, Nvidia is expected to report adjusted earnings per share (EPS) of $0.65 on revenue of $28.7 billion. That works out to a 139% jump in EPS and a 113% increase in revenue compared to the same period a year ago when Nvidia saw EPS of $0.27 and revenue of $13.5 billion.

Nvidia is the world leader in AI chip design and software, controlling between 80% and 95% of the market, according to Reuters. And it’s expected to continue to hold that lead as it begins rolling out its next-generation Blackwell line of chips.

And while The Information has reported about a potential delay in Blackwell shipments, analysts at firms including Goldman Sachs, KeyBanc, and Loop Capital don’t see that as much of a concern for Nvidia in the near term.

“Our work suggests that while Blackwell is in fact delayed as we first wrote about on [Aug. 8], it could be more like 120 days vs 90 days … although it may not matter much as [1)] Hopper yields from TSMC continue to improve and [2)] The amount of increased Hopper production through the fall may outweigh the amount of Blackwell forgone by the push out,” Loop Capital managing director Ananda Baruah said in an investor note.

For the quarter, Nvidia’s all-important data center business is expected to bring in $24 billion in revenue, a 142% increase from the $10.3 billion the segment saw in the same quarter last year. Wall Street is expecting Nvidia to not only beat its Q2 expectations but raise its guidance for Q3, something that could be backed up by TSMC’s recent earnings beat. TSMC produces chips for Nvidia.

That jump in data center growth, however, is lower than the 426% in revenue growth last quarter and 408% in Q4 last year.

That growth is expected to slow further in Q3 when the company is expected to see data center revenue of $27.7 billion, a 91% year-over-year increase.

“We’re thinking that Nvidia is going to do close to $30 billion in data center revenue in October. And so, you know … the law of large numbers [is] here,” Stifel managing director Ruben Roy told Yahoo Finance on Monday. “But we do think, again, that the profitability of the company will continue to grow.”